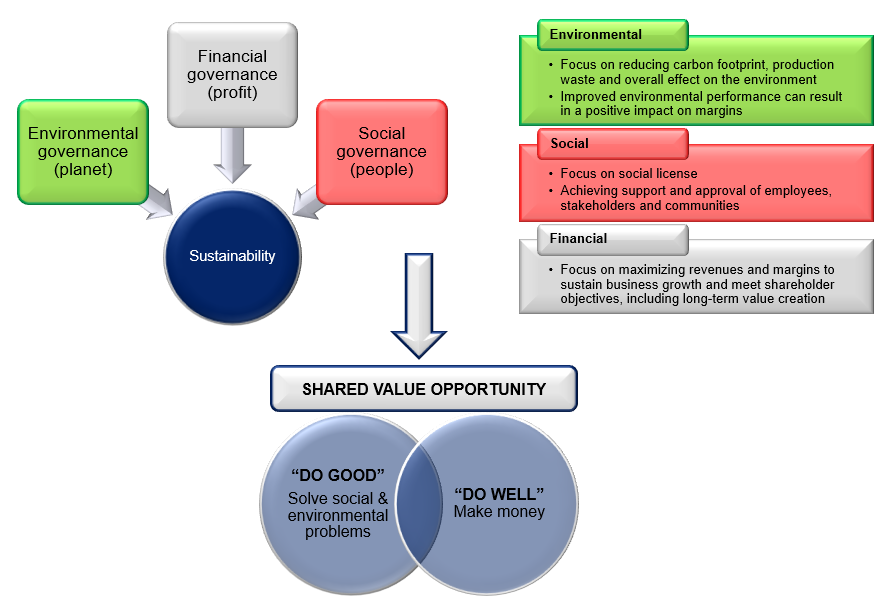

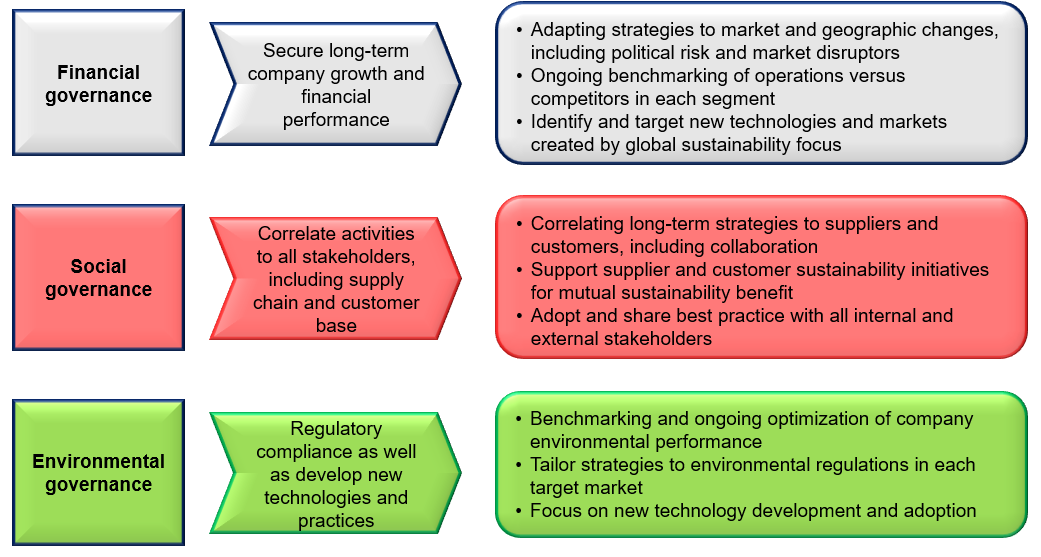

There is more to a company’s sustainable performance than its environmental footprint. Sustainability is made up of three governance “pillars” – environmental, social and financial.

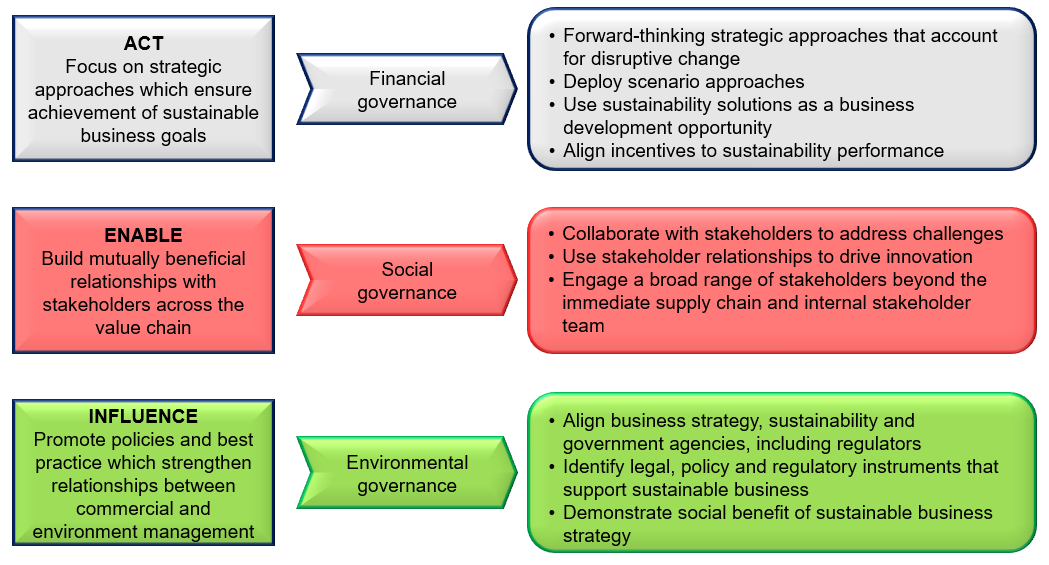

Long-term value creation for businesses is contingent on resilient strategies which continually adapt to a changing world. Sustainability is core to resilient strategy development.

- While the business landscape continues to change, there are three inter-relating constants which form the basis of resilient business strategies – “act”, “enable” and “influence” – and link closely to the key sustainability pillars.

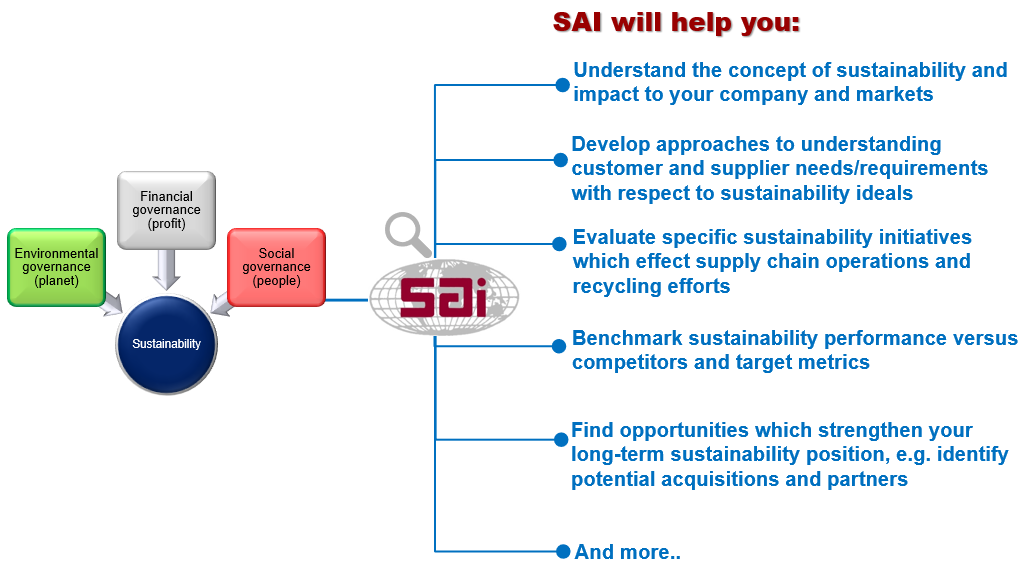

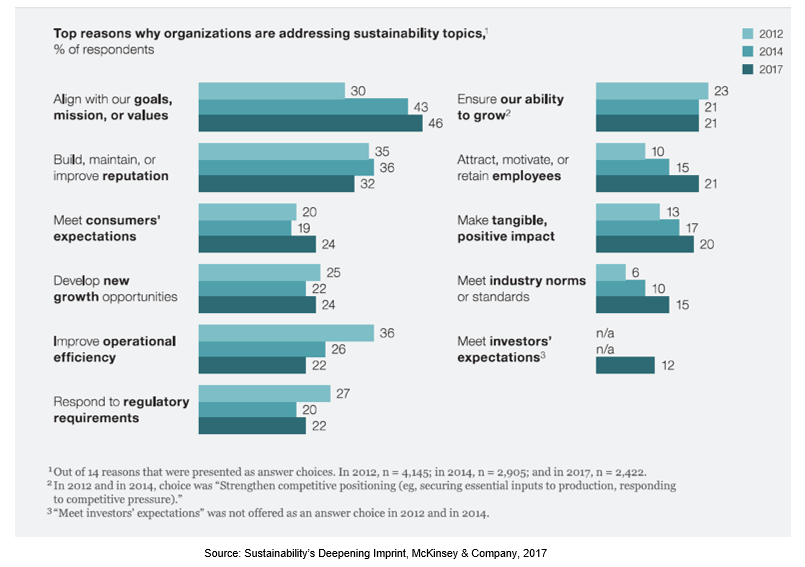

Sustainability factors have become increasingly important as a component of strategy development and building company image but also fostering customer and supplier relationships.

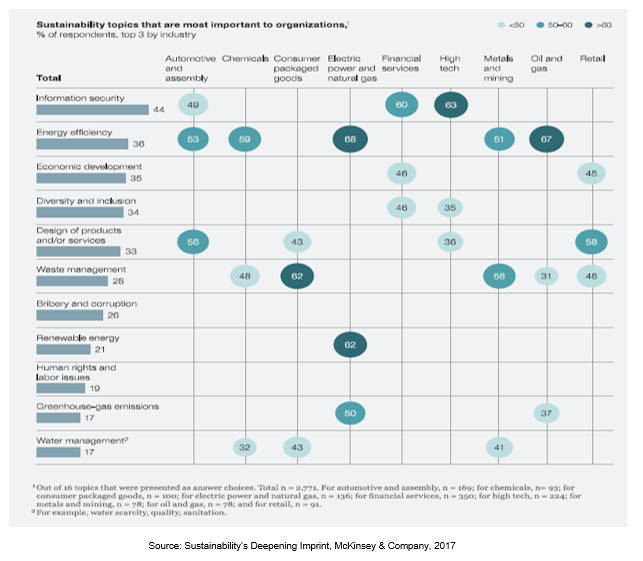

Emphasis on individual sustainability factors varies by industry but key focus is on information security, energy efficiency and economic development.

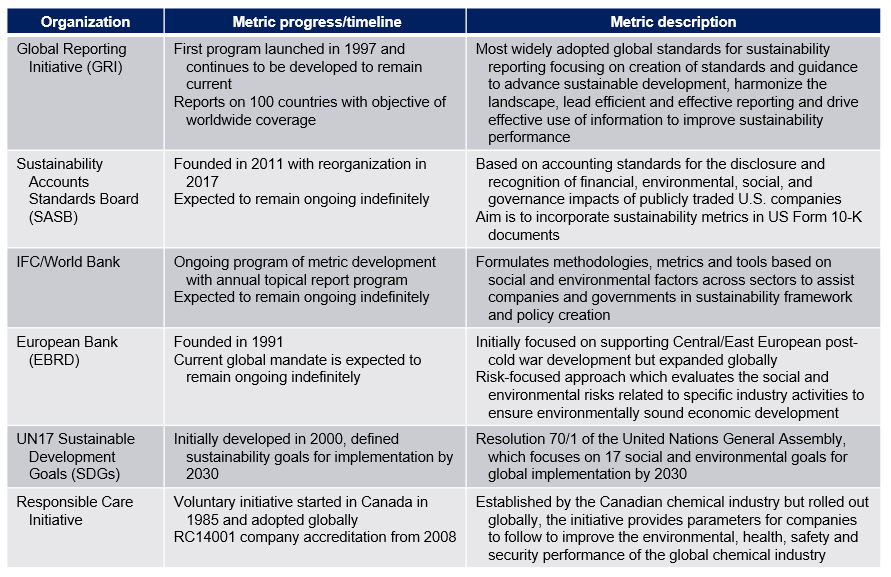

Organizations are developing standardized metrics to facilitate sustainability evaluation and metric benchmarking which continue to be under development.

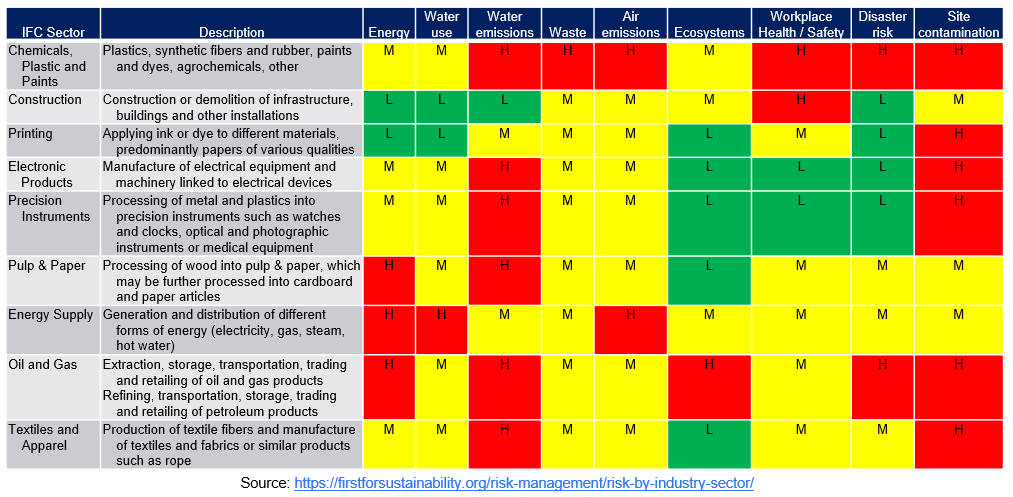

EXAMPLE 1: ENVIRONMENTAL AND SOCIAL RISK BY INDUSTRY SECTOR – IFC/WORLD BANK

- IFC/World Bank assesses the level of environmental and social risk for different types of industry sectors to determine the extent of environmental and social due diligence that will be required for a particular transaction. Companies operate in a variety of industry sectors with a range of environmental and social risks

- Select environmental and social risk assessments according to the IFC/World Bank Environmental, Health, and Safety Guidelines:

- High Risk: Business activities with significant adverse environmental and social impacts that are sensitive, diverse, or unprecedented. A potential impact is considered sensitive if it may be irreversible (such as loss of a major natural habitat), affect vulnerable groups or ethnic minorities, involve involuntary displacement and resettlement, or affect significant cultural heritage sites

- Medium Risk: Business activities with specific environmental and social impacts that are few in number, generally site-specific, largely reversible and readily addressed through mitigation measures and international best practice

- Low Risk: Firms / businesses with activities with minimal or no adverse environmental and social impacts

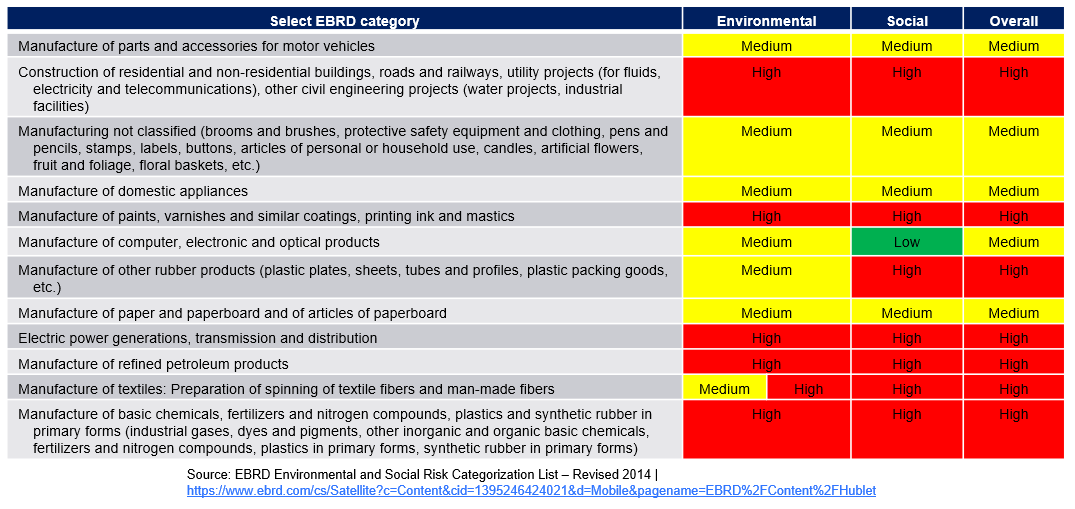

EXAMPLE 2: ENVIRONMENTAL AND SOCIAL RISK BY INDUSTRY SECTOR – EUROPEAN BANK

- European Bank’s Environmental and Social Risk Categorization of the typical level of inherent environmental and social risk related to select business activities

- Environmental: Any temporary or permanent changes to the landscape, atmosphere, soil, water, plants or animals caused by human activities

- Social: Labor standards, impacts such as public health, safety, security, gender equality, Occupational Health and Safety, others

- Overall: Balanced assessment of the combined environmental and social risks

ACTIVITY RISK

-

- High: Business activities may give rise to significant or long-term environmental and social risks and impacts

- Medium: Business activities have limited environmental and social risks and impacts, and these are capable of being readily prevented or mitigated through technically and financially feasible measures

- Low: Business activities have minor / few environmental and social risk and impacts associated with them

Sustainability methodologies can be tailored to individual company objectives to provide an essential tool in creating resilient company strategies.

- Correlating with competitive intelligence takes sustainability methodologies beyond a specific industry, segment or geography and provides an adaptable tool for long-term strategy development and ensuring performance remains in line with company objectives

SAI SERVICES IN SUSTAINABILITY