Key Definitions:

ACTIVE PHARMACEUTICAL INGREDIENT (API)

A substance used in a finished pharmaceutical product, intended to furnish pharmacological activity or otherwise have direct effect in the diagnosis, cure, mitigation, treatment or prevention of a disease or to have direct effect in restoring, correcting or modifying psychological functions in human beings

HIGH-POTENCY API (HPAPI)

The compound is generally defined as highly potent. If it has an occasional exposure limit (OEL) of less than 10 µg/m3, a daily therapeutic dosage of less than 10 mg/day or if one mg/kg/day dose produces serious toxicity in laboratory animals

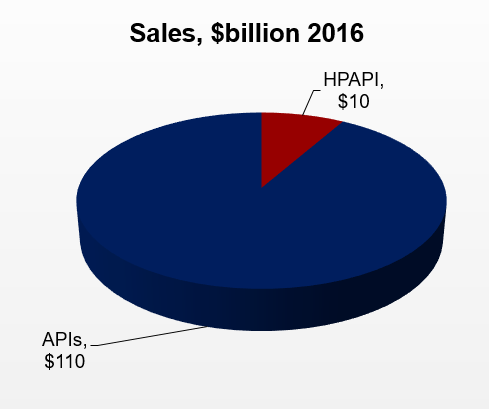

The API Market – Large & Rapidly Growing Business

- Global sales of APIs are about $120 billion in 2016, including captive manufacturing and will grow to nearly $200 billion by 2021

- Global sales of HPAPIs are estimated at $10 billion in 2016

- While the API market is growing at a healthy rate of nearly 7% a year, HPAPIs are growing at a much faster rate in the low double digits

Industry Trends

- Small molecules dominate and account for about 80% of the market

- The number of small molecules approved by the FDA in the last four years has averaged around 20 to 30 per year

- The late stage pipeline of over 600 small molecules provides over 3000 short-term outsourcing opportunities based on multi-step syntheses and the trend towards outsourcing is increasing

- By 2020, about 230 small molecule blockbuster drugs will be on the market

- This resurgence is driven by chemical drug development in:

- Anti-viral

- Oncology

- Immunosuppressant

- Anti-diabetic therapy classes

- Recent shift in focus to high-quality, local suppliers provides further opportunity for the United States and Europe manufacturers

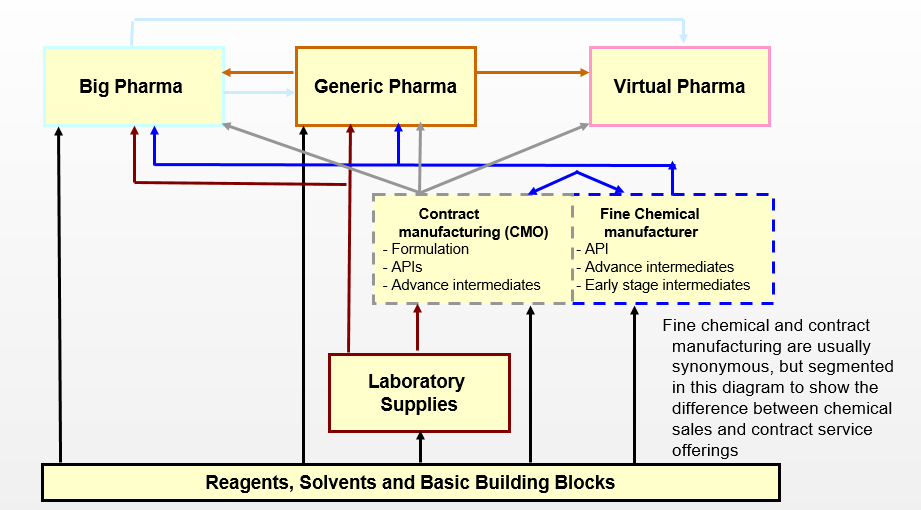

Pharmaceutical Value Chain

- The value chain is heavily influenced by the world of big and generic pharma

- Fine chemical manufacturers have experienced shifts in the product philosophy due to historical market factors which has translated into widespread under-utilization of assets

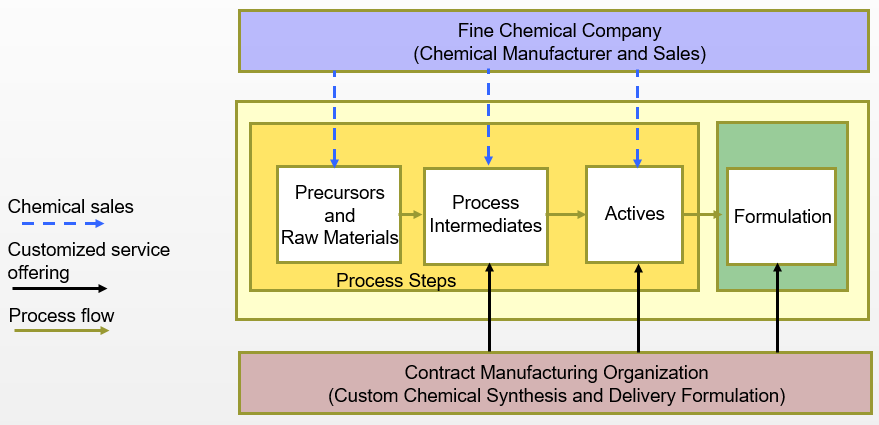

Fine Chemical & Custom Manufacturers

- Fine chemical manufacturers and CMOs serve two purposes in the pharmaceutical market

- Supply of fine and specialty chemicals

- Custom synthesis of advance intermediates and APIs

- Advanced formulation services typically provided by specialized CMOs not affiliated with fine chemical companies (e.g., sterile injectables)

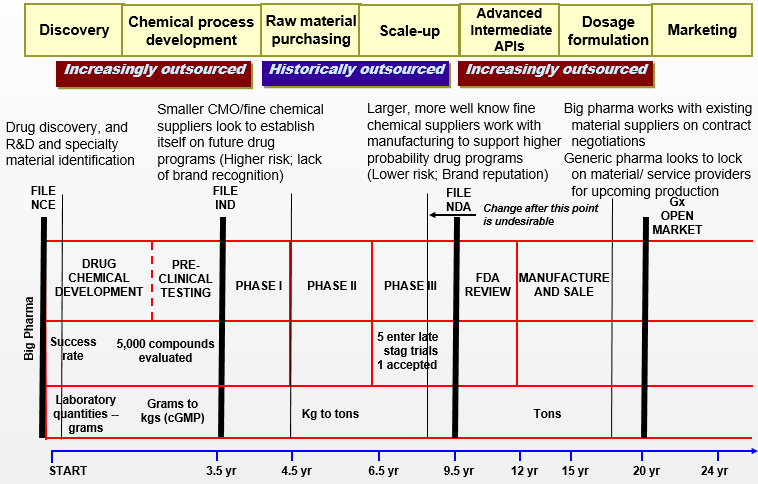

Pharmaceutical Drug Development & Purchasing Schemes

Top 50 Suppliers of Small Molecule API’s

- Market is still highly diffuse

- Top 20 companies account for less than 40% of the market

AbbVie

Aesica

Albemarle

Almac

AMPAC

Aptuit

Ash Stevens

Avid Bioservices

BASF

Cambrex

Codexis

Corden Pharma

CU Chemie Uetikon

Dishman

Dottikon

Dr. Reddy’s

Evonik

Fareva

FIC

GSK

Halo

Heisinn

Hetero

Hisun USA

Hospira One2One

IDT Australia

Infa

IRIX

Johnson Matthey

Lanxess

Lonza

Neuland

Novasep

PCI

Penn

Pfizer CentreSource

PharmaCore

Pharmazell

Piramal

Regis

SAFC

SAI

Sanofi CEPIA

Siegfried

Solvias

Stason

Takeda

Wockhardt

Wuxi AppTec

Zach

Top Ten Suppliers

- Top ten competitors account for about 25% of the market

- BASF

- Evonik

- Lonza

- Saltigo (Lanxess)

- Johnson Matthey

- Teva

- Sumitomo Chemical

- DPX (DSM/Patheon)

- Cambrex

- Siegfried

- The leading manufacturer accounts for only 5% of the business

Conclusions

- The market for APIs is large and growing at a strong rate

- The business is now driven by small molecule development and will continue for the near future

- While many competitors compete in this business around the globe, no company dominates

- The top ten manufacturers only account for 25% of the business and the leader is estimated to have only a 5% share

- The pharmaceutical development is still concentrated in the United States and Europe

- The industry is interested in a dependable supply chain in terms of development, delivery and quality and, as a result, local supply is becoming important

- The Asian players, of which there are many, will continue to play a role in the business, but much of the manufacturing is focused on commodity compounds and less sophisticated manufacturing know-how

- As a result, SAI believes that there are many opportunities for companies looking to expand their businesses

SAI, a leading international business consulting firm with 375 employees in 13 operations worldwide with staff in North America, Europe, Brazil, India, and China has analyzed the ingredients used in the manufacture of pharmaceuticals, including APIs and excipients for over 30 years

As you review this attractive market opportunity, SAI’s staff is available to provide expert knowledge, analysis and advice to help you achieve your objectives. Click here to contact us today.